CELENTE: DOT-COM BUST 2.0 Will Crash the Nasdaq This Year

We forecast that as the U.S. equities weaken in the tech sector—and the reality hits The Street that much of the tech sector is over-speculated

NOTE TO READERS: THIS ARTICLE WAS FOUND IN THIS WEEK’S ISSUE OF THE TRENDS JOURNAL. SUBSCRIBE NOW FOR HISTORY BEFORE IT HAPPENS

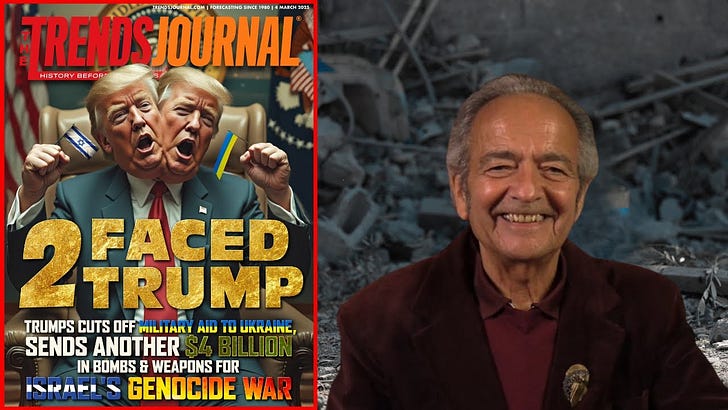

As we have detailed, two of our Top Trends for 2025 have been dealt with and continue to be dealt: The Trump Card and The Wild Card.

Living up to his campaign promise, today President Trump imposed a 25 percent tariff on Mexican and Canadian imports and another 10 percent tariff on Chinese products coming into the United States.

With the fear that tariffs will push prices higher and economic growth will retract, The Street is now warning that the U.S. economy will stagnate.

Indeed, a CNBC headline today shouts out that Stagflation fears bubble up as Trump tariffs take effect and the economy slows.

No, the economy will not stagnate. America, like economies of much of the world, will decline and inflation will rise, thus it will be Dragflation.

And again, where this goes and how quickly it will happen is difficult to forecast since with the Trump Cards and the Wild Cards being dealt, it is an “Anything Goes” world of wonder.

Today the Dow fell 670 points.

Yesterday, following Trump’s tariff announcement, the Dow was down 650 points. Is this just the beginning of a market correction or a stock market crash? Today the Nasdaq was a fraction away from slumping into correction territory before rebounding a bit, while the S&P 500 turned red, down nearly 2 percent year-to-date.

No surprise to Trends Journal subscribers.

As you well know, back in January, when DeepSeek charged into the AI world, we had forecast Dot-com Bust 2.0.