European Gas Buyers Reportedly Pay Moscow in Rubles, Major Blow to Biden

US President once said ruble would turn to 'rubble'

Note to readers: The new Trends Journal was released Tuesday and was packed with the latest trends in the Ukraine War and economy that you need to know. Please consider subscribing here.

What a difference a month makes.

In March, President Joe Biden was so excited about destroying the Russian economy through sanctions, he took to Twitter to announce that the Russian ruble was almost immediately “reduced to rubble.”

It was almost the Biden administration’s equivalent of George W. Bush’s “Mission Accomplish” photo taken on the deck of the USS Abraham Lincoln on 1 May 2003.

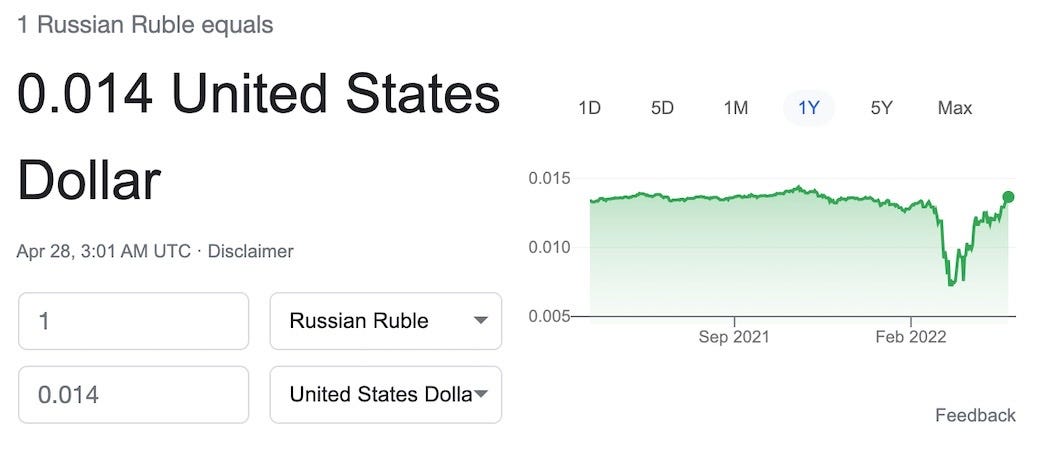

And while correct early on - the ruble did sink 30 percent against the U.S. dollar - the tide has since changed. The Russian currency has traded at a two-year high against the euro on Tuesday and Russian stock indexes are also on the rise. Russia is turning the ruble into a commodity-backed currency.

As Ronan Manly from BullionStar wrote:

“Russia is the world’s largest natural gas exporter and the world’s third largest oil exporter. We are seeing right now that Putin is demanding that foreign buyers (importers of Russian gas) must pay for this natural gas using rubles. This immediately links the price of natural gas to rubles and (because of the fixed link to gold) to the gold price. So Russian natural gas is now linked via the ruble to gold.”

Bloomberg, citing a person close to Gazprom, the Russian gas giant, reported Wednesday that four European buyers have already sent payments in rubles – acquiescing to Russian President Vladimir Putin’s demands. The Italian energy giant Eni SpA is preparing to open ruble accounts at the bank, the report said.

The report went on to say that a total of 10 European companies have agreed to open accounts at Gazprombank to make the payments. Poland and Bulgaria were cut off from Russian natural gas because they refused to pay in rubles. Historically, these countries would pay about 60 percent in euros and 40 percent in dollars.

BIDEN BRAGS ABOUT WEAPON TRANSFERS

"Payment in proper form will be the basis for the continuation of supply," Dmitry Peskov, the Kremlin spokesman, said. Politico pointed out that Putin signed the decree on 31 March that demands these payments in rubles.

Peskov pointed to how the West essentially “stole” more than $300 billion in Russian central bank’s currency reserves. Russia called the the seizure of about $600 billion in gold and foreign exchange reserves “unprecedented on a global scale.” (WATCH: GERALD CELENTE AND JUDGE NAPOLITANO ON ‘ILLEGAL’ SEIZURES)

Shatter the Alliance?

Andriy Yermak, Ukrainian President Vlodomyryr Zelensky’s chief of staff, said, “Russia is trying to shatter the unity of our allies.”

Ursula von der Leyen, the European Commission President, said Wednesday that companies should not pay for gas in rubles. She has accused Moscow of weaponizing its energy sector. Oil and gas sales provide Moscow about 40 percent of the country’s revenues and the EU is Russia’s main gas market, The Wall Street Journal reported.

“Companies with such contracts should not accede to the Russian demands,” von der Leyen said. “This would be a breach of the sanctions so a high risk for the companies.”

One person took to Twitter, and posted, “The Russian ruble is now higher than before Ukraine invasion, Looks like sanctions are working, Working to make Russia richer.”

Some observers say Moscow was preparing to absorb these sanctions well before the invasion, and had a strong plan in place. For example, Russia froze assets that were held by nonresident investors and its central bank has more than doubled interest rates to 20 percent in an effort to entice Russians to keep their money in rubles. Opponents of Russia’s monetary policy say once these actions are lifted, the ruble could collapse.

Before the invasion, the ruble was valued at approximately 84 rubles for one U.S. dollar and fell as low as 139 rubles per dollar after the first shot was fired. The currency fought back to 74 rubles per dollar. The sanctions that Biden has put into place are directly responsible for the surge because banning Russian oil and gas resulted in soaring prices, which has been historically good for the ruble.

Dollar Reduced to Rubble?

Western sanctions against Russia could reduce the dollar’s dominance by allowing countries to become used to paying for imports using other currencies, Gita Gopinath, the International Monetary Fund’s first deputy managing director, said in a Financial Times interview earlier this month.

“The dollar would remain the major global currency even in that landscape,” she said, “but fragmentation at a smaller level is certainly quite possible.”

“We already are seeing that, with some countries renegotiating the currency in which they get paid for trade,” she noted.

Jen Psaki, the White House press secretary, said the U.S had been preparing for the move.

"Some of that has been asking some countries in Asia who have excess supply to provide that to Europe. We've done that in some cases, and it's been an ongoing effort," Psaki said, according to The Associated Press.

TREND FORECAST: As we said in “China’s Digital Yuan Could Challenge Dollar’s Leadership” (27 Jul 2021) history shows that the currency of the world’s leading economy also becomes the world’s reserve currency for international trade.

In 1890, when Britannia ruled the waves, the pound sterling was the standard; after World War Two, when the U.S. had the only large, functioning economy, the dollar rose to prominence.

All signs indicate that China will overtake the U.S. sometime in the next 10 to 15 years as the world’s largest economy. When that happens, (click here for the premium content.)

IN CASE YOU MISSED IT