MANNARINO: Global Debt Time Bomb Close to Detonating

Every second of every day, global debt is climbing. The “big secret” is this: it can’t ever stop.

NOTE TO READERS: The following is one of dozens of economic articles in this week’s issue of The Trends Journal. Consider subscribing here for in-depth, independent geopolitical and socioeconomic trends and trend forecasts that you won’t find anywhere else.

By Gregory Mannarino, TradersChoice.net

Consider this: As you are beginning to read this article, global debt is surging higher.

In fact, global debt has never been higher than it is today. But in the few minutes that it will take you to finish reading this article, global debt will have surged even more.

Every second of every day, 24 hours a day, global debt is climbing. The “big secret” is this: it can’t ever stop.

It can’t ever stop because at its core the “modern” monetary system is debt-based.

ECONOMIC UPDATE: THE GREAT RECESSION IS HERE

The entire worldwide financial system is totally dependent on the relentless acquisition of exponentially more debt in greater and greater amounts just to function. And what it cost an hour ago just for the system to function will require even more debt an hour from now just to function.

And so on…

For many months now, but especially as of late, we have been witnessing a phenomenon, a “whipsaw” action in global bond yields- and that is a problem.

The entire financial system, the economy, and the world’s stock markets depend on a stable bond market. The recent “whipsaw/up and down” gyration action in the world’s debt market is a clear signal that something is breaking.

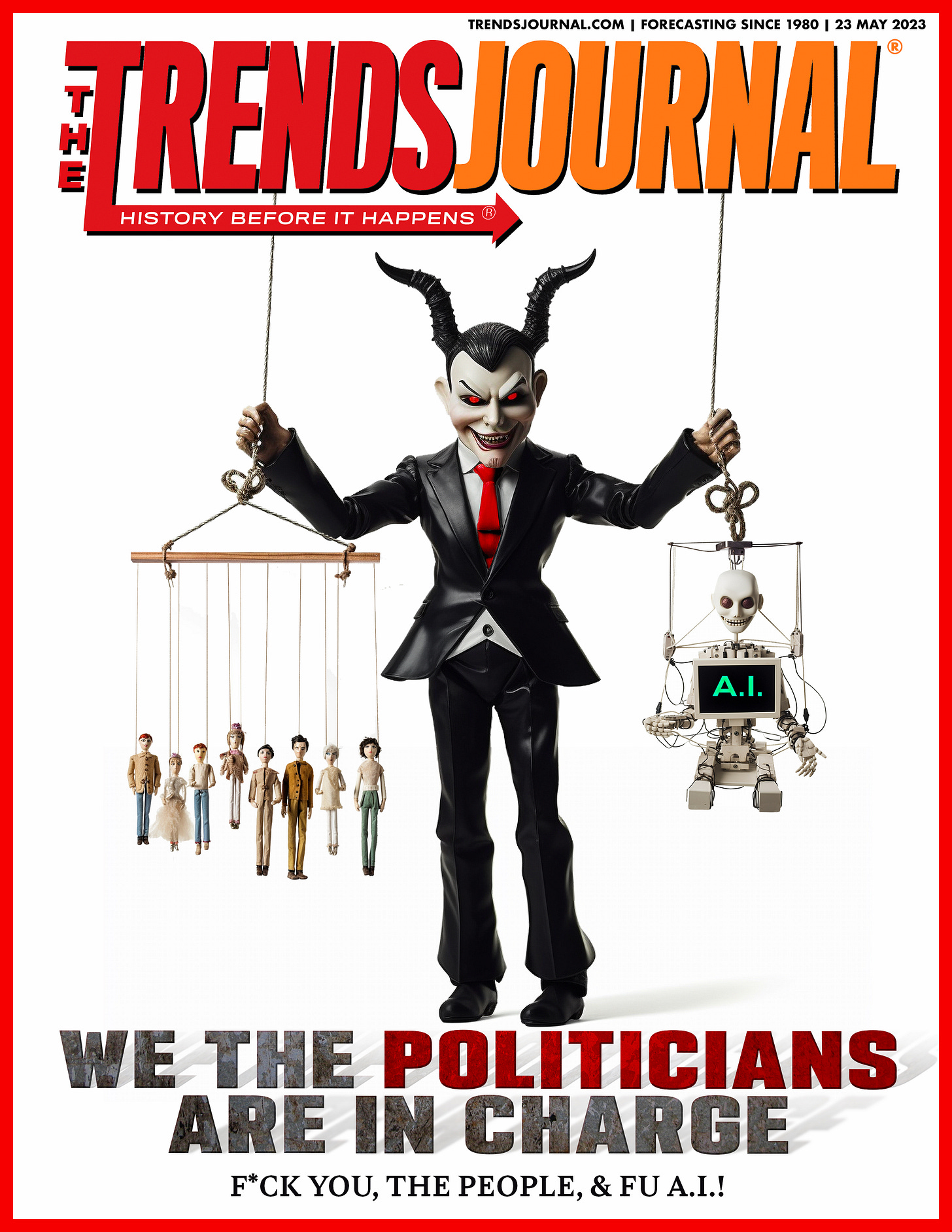

Keeping credit flowing to the large, multinational institutions fulfills the corporate agenda of eliminating small business—they do not want any competition, especially when the new system is rolled out.

The bigger issue is that although the world is flooded with debt, it operates in a perpetual debt deficit, as the system constantly demands even more debt be pulled into the system in order to keep functioning.

Central banks, to keep the debt-based system going, must inflate. That is, they must create more debt. Central banks create only one product, debt. The ability of a central bank to produce debt and then issue that debt is how they stay in power.

Central banks understand that the current monetary system has been pushed to the breaking point, they themselves have done this. Moreover, they have been aware for decades that this would eventually happen—they have been planning for it.

The first stage in the breakdown of the current system is well underway, which can be seen in skyrocketing worldwide inflation and rising labor costs.

The second stage is also well underway, with debts and deficits hyper-ballooning.

What central banks are currently in the process of doing, in order to push off what will eventually be a complete locking up on the system, is lessening the availability of credit to small businesses and the consumer, but making sure to keep credit flowing to the large institutions.