MANNARINO: Near-Term Stock Market Meltdown or Melt-Up?

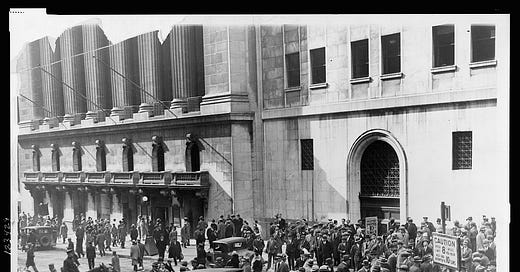

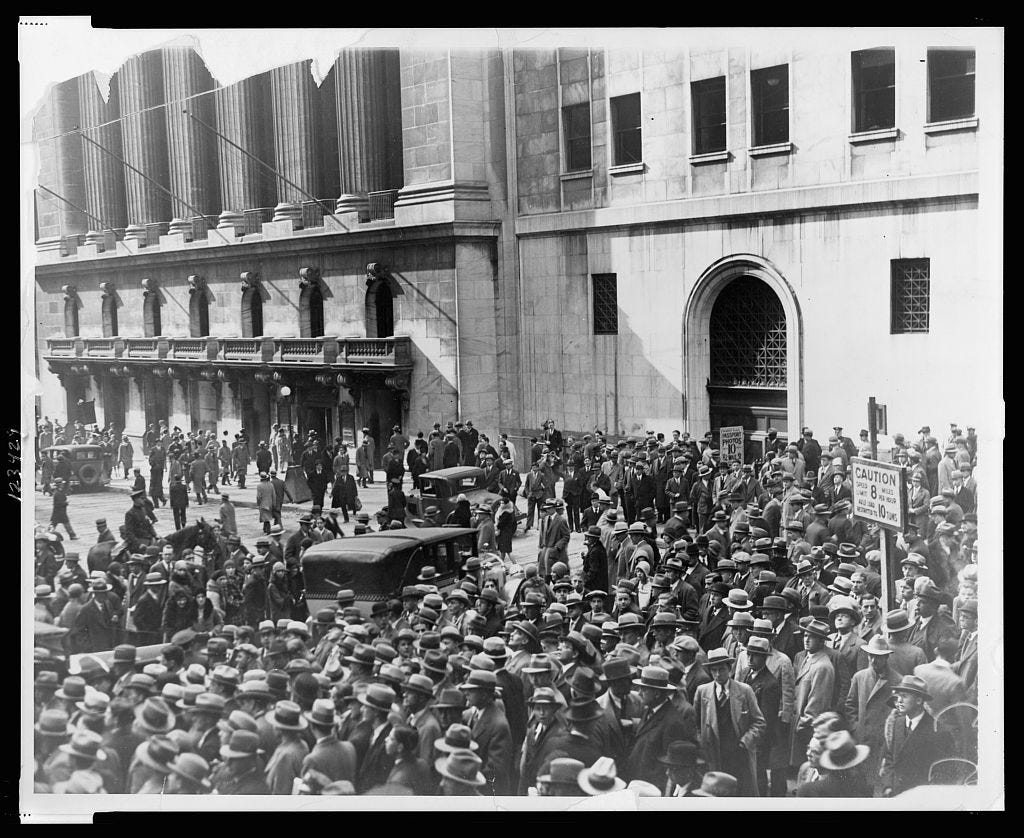

The Bank Panic of 1907, the Stock Market Crash of 1929, Black Monday 1987....all these events happened during the month of October

By Gregory Mannarino, TradersChoice.net

Octoberphobia.

The specter of October stock market crashes looms large in the minds of many, and for good reason.

Just to name a few.

There was the Bank Panic of 1907, the Stock Market Crash of 1929, Black Monday 1987.

All these events happened during October.

Then, most recently, there was the sub-prime housing market crash which precipitated the stock market crash of 2008.

These events have imprinted a psychological scar upon the minds of the masses. Therefore, every year when October rolls around the calls for stock market crashes during this month skyrockets.

The anxiety of October, although understandable, must be looked at in the context of what is driving stock market price action at that time. By closely observing the flow of cash through the markets, we can make good calls as to what the most likely outcomes for the market will be.

What is driving stock market price action today?

It’s the same driver ever since the stock market crash of 2008. The NUMBER ONE market driver remains hyper-debt expansion, which is brought about directly by central bank easy money policy.

Hyper-debt expansion, and this is a worldwide phenomenon, has triggered what is known as a multiple’s expansion cycle in the stock market.

A “multiples expansion cycle” is the direct result of artificially suppressed rates and therefore, a weaker currency. In simple terms, it means that investors are willing to pay more to own the market. Multiple expansion cycles create stock market bubbles, along with MASSIVE price action distortions across the entire spectrum of asset classes.

ALSO:

CELENTE: PREPARE FOR A VERY, VERY WILD CARD

For many years now I have explained to the people who follow my work that “The Faster That the Economy Craters, The Higher the Stock Market Will Go.” Let’s see how this mechanism works.

The same forces which drive the stock market higher, are also ECONOMIC DESTROYERS.